Boys and (mythical) girls, circle around and let’s have a quick chat!

The Civil War 2 series has always been a half-serious jaunt down some of the derpiest side roads of reality. However, these days, it seems that every Tom Hairy Dick… Erm… I mean Tom, Dick, and Harry is prognostifying on the likelihood of the conflict of many names. Frankly, I don’t like all them Johnny come latelies stealing my thunder.

Well, joke’s on all you usurpers! I’m going serious-ish. Well, kinda.

See, unlike when I started the series, pointing out the nuggets of instability that had the potential to interact violently, I’m writing from within a tinderbox today. The only things keeping us from all being at one another’s throats are an economy that is wheezing along and a right wing that is still trying to figure out what the hell hit it.

I’ve been warning for a while that Big Non-Profit is probably the most pernicious of the Media-Education-NonProfit-Government complex the progressives have built, and the right, if they’re paying the slightest bit of attention to the left’s taunts (https://time.com/5936036/secret-2020-election-campaign/ ). You don’t fix this kind of stuff by electing another establishment GOPer to Congress. You don’t fix it by marching in the streets with signs. You don’t fix it by sending angry letters to the local newspaper or ranting in the comment section of your favorite media outlet.

There are only two reactions the right has (and only two reactions the rest of us have, too). Hide or fight. The right will resort to violence, and not the half-assed excuse for a riot that is currently being called “insurrection” . They will resort to violence because there are some who aren’t content to hide.

The signs are all there, except for one.

Institutional corruption: ✔️

Complete destruction of institutional trust: ✔️

Rapid curtailment of individual liberty and quashing of dissent: ✔️

Questionable assumption of power: ✔️

Group in power stripping away the traditions of civility and decorum: ✔️

Dissent impacting employment and other economic relationships : ✔️

Disaffected class prevented from having success by those in power: ✔️

An economic vise of lagging productivity and bubbling inflation: ✔️

Complete disconnect of worldview between those in power and those without power: ✔️

The only thing missing is a catalyst. I thought the Nashville car bombing may be it. I thought the Capitol riot may be it. You strike a match enough times and it’ll flare up. That said, I don’t think the economic ramifications have fully set in yet. People still have too much to lose to bother getting violent. Surprising as it is, our society and our economy showed off some unexpected resiliency in 2020. Now the question is how much of that resiliency is real and how much is a facade. Tune in throughout 2021 to find out!

The reality is that I’m no Nostrildamus. The tensions that are plainly evident in our society could erupt tomorrow, or we could be in the equivalent of 1850, decades away from widespread violence. Similarly, the economy can start showing stronger effects of all the profligate spending tomorrow, or it could be a year until the inflation hits us in earnest.

That all said, I’ve been of the opinion that we’ll see a few months of cooler heads prevailing. The prog-fascists got what they want, so they will enjoy their spoils. The next conflict point is either when the left decides to spike the football in particularly egregious fashion or when the economy catches up to the fiscal lunacy. Until then, all we can do is prep for the inevitable.

it could be a year until the inflation hits us in earnest

I’m starting to hear quiet inflation warnings from real asset managers. I used to have a line to Goldman Sachs, years ago. I’d love to know what they are saying behind closed doors. They may be sociopathic greedheads, but they are good at what they do.

And I do think that will likely be the catalyst. Every asset class is in a bubble right now. The Fed is boxed in, because they can semi-manage deflating one bubble, but not multiple bubbles. Housing bubble? Raise interest rates. Equity bubble? Raise interest rates. Bond bubble? Oops. Lower interest rates. And guess which is the biggest asset class.

On the inflation front, the ATM’s in my area have started to add $50 bills to the machines. Previously, they only did $20’s.

I still have no real idea where I should be parking investment money to get some gains. I’ve continued my monthly (or more) deposits into my brokerage accounts, and kept up the 401k contributions.

Its odd. I swear I never saw a $50 in the wild until last week.

Clearly you dont do transactions with my Mother.

[wow, unintentional softball tossed, have at it]

Nope. Just Winston’s Mom. Value for the money.

Same as downtown?

THERE’S your evidence of inflation right there! It used to be $20.

*sees badly injured goaltender heaped under a pile of defensemen cutting each other inadvertently with their skate blades, chips puck over glass*

Your mom is a weed connection?

Ha! I once had a friend call me back to ask if I might be so kind as to return and replace the Hundred Dollar notes I had just given him with Twenty Dollar notes, as the bodega on his corner refused the larger bills.

She said I was worth that fiddy.

I don’t know either but if the 401k’s ever get squashed then you will see true anger from the masses.

I used to think that, now I’m not so sure.

It would depend in part on the duration. 2008 and 2020 both dropped and then started to recover within months. If people think the stock market will be in a bear market for a long time then I’m still holding to the original prediction.

Also depends on if it’s the market collapsing, or if it’s a change to the program to require people to shift a certain percentage of their 401k holdings into “safe certified investments” (such as government bonds).

I still think that’s coming. Its slow-motion confiscation of 40(k)s to shore up government spending by forcing a market for the debt that finances it. Its already been surfaced a couple of times.

CA is starting a different approach to this. All employers who don’t offer a 401k are required to auto-enroll employees in a savings program that I believe dumps some percentage in “safe” CA muni bonds or something similar.

As far as 401ks and trad IRAs, I think the first step is going to be forced conversion to Roths.

I’m going to be mighty pissed if they take away the tax credits for investing in a 401k. I did a bit of back-of-the-envelope math, and I’m guessing that would cost me a good $400/year, and I’m in the sub-$15/hr class.

If the 401(k)s get crushed, it will be blamed on “market failure.” That should be enough of an excuse for the feds to takeover those funds and promise everyone “guaranteed” retirement money.

I can accept market losses there – but not the govt stealing it from me.

I continue to dollar cost average into the market. **shrug** Of course, dollar cost averaging on the way up isn’t as sweet as doing it on the way down before the bounce.

Like this time last year.

Yep. I’m still feeding the money in, but I’ve lost confidence that it’s the right play now.

I had one dole out multiple, sequential #’d $2 bills last week.

Super odd.

There were a couple of ATM’s near some of the colleges my friends went to that would offer up $1 bills for the broke-ass college students.

ATMs in NYC have been giving out fifties for a decade or more. It got so bad that I changed my quick cash or whatever they call it to $120 so I could guarantee I’d get at least one twenty.

Had a chat with an investment advisor this morning. He recommends the “Consumer Discretionary” sector for the remainder of 2021.

Thinks airlines, cruise lines, other hospitality venues that have been hard hit are good buys right now.

I still have no real idea where I should be parking investment money to get some gains.

My next article addresses this. My answer? Erm.. Uhh… Not sure.

A year and change ago, the 12-month CDs at my credit union were getting about 1.5%. Indeed, I was planning on parking my 6-month emergency reserve in a series of CDs I could roll over to keep up relatively closely with inflation.

Last I checked, 60-month CDs are getting 0.75% a year.

At .75% a year, it seems your money would grow faster in a shoebox under the bed.

I’ve been parking the majority of my (non-401k) investment savings into an auto-balancing account that’s heavily weighted towards stocks (which is then split among ETF’s).

On the inflation front, the ATM’s in my area have started to add $50 bills to the machines.

That’s been a slow trend for a while here with in-lobby but not drive-in ATMs.

Correction: After I hit post, I realized there is one drive-up ATM near me that will give out 50s and 100s. Otherwise, I know of no other drive-up ATMs that will do it.

My bank does $50 and $100 bills, but not at the drive through ATM. You have to go to the one in the vestibule.

Our financial advisor called us out of the blue last week to warn us about inflation. There was no other reason for the call other than to tell us we should expect a good amount of inflation to occur late 2021 or in 2022.

Look at the price of a McDonalds Value meal.

It continues to go up.

Almost $10 per meal.

McDonald’s commercials back in the mid-1970s (when the tagline was “McDonald’s is my kind of place“) touted that “…at McDonald’s family restaurants, you can feed a family of four for about $2.50!“

I don’t understand McDonald’s pricing. They should be the absolute cheapest meal around. But I can get a lunch special ribeye cheesesteak with fries for 6 bucks from the local Italian restaurant. Or lunch special fajitas for $7 with rice and beans from the local Mexican restaurant. Either meal has much better ingredients, larger portions, and cooked fresh to order on a grill.

I use it as a barometer of inflation.

I’m following you… that was more of an aside. The WSJ has been following their struggle to stay relevant for the past few years as they moved away from the original business model of serving cheap food fast and hot.

Someone’s gotta subsidize all the salad that goes bad.

I’m beginning to think inflation isn’t going to be the problem it should be, largely because we are still the world’s reserve currency. Everything floats with us. Not the microsecond that changes, we’re 70s era Argentina.

I’m beginning to think inflation isn’t going to be the problem it should be, largely because we are still the world’s reserve currency.

Well, until we aren’t. The pound was the reserve currency, until it wasn’t. Of course, the dollar was waiting in the wings, and right now there isn’t an heir apparent to the dollar.

And, of course, the dollar was the reserve currency in the ’60s and ’70s, and we still had kinda bad inflation.

But as long as the dollar is the reserve, we can definitely spread the inflation over a larger base. Yay us?

THIS

you two are exactly correct

Internally-precipitated inflation is nominal. Take the value of all assets denominated in dollars and dilute it by $4T a year or so and it’s no big deal. It’s stupid; it’s unnecessary; it’s wrong that we do that to savers; but it’s not widely fatal.

When no one in London or Tokyo or is willing to trade a gallon of WTI for a green linen picture of George Washington anymore, we are suddenly hogtied and fucked.

Stop stealing my next article’s thunder!!

(you all are completely right, by the way)

Unintended consequences (at least I suppose unintended) of Nixon’s petro-dollar deal with the Saudis.

I remember a few years ago reading stories about some countries signing agreements to settle trade in currencies other than the dollar. What I remember of the articles is it was general trade goods (in other words, not specific to petroleum) and the countries were small.

There is some rumbling towards moving away from the US Dollar, but not big enough to matter. Yet.

right now there isn’t an heir apparent to the dollar

Bitcoin.

Not a chance, at least not yet, and probably not ever.

Correct.

It’s a fun idea and useful in very limited circumstances.

Correct.

The blockchain updates won’t scale to the level credit card processors handle. It’s been a while since I looked at it, but at the time, there were orders of magnitude difference between what Bitcoin can handle and what credit card processors currently handle.

Some of the newer crypto currencies might have some improvements/ideas on how to handle this level of scale.

we’re 70s era Argentina.

-1 decent soccer league

Loaves of bread have been getting smaller and there’s less wine in wine bottles. That’s your quiet inflation.

Wine? Isn’t the standard wine bottle 750ml? Granted, that’s about 7ml less than a fifth, but that’s been the standard size, with 1.5L being a magnum, for as long as I can remember.

Other beverages, sure. And other foodstuffs too. Dad had trouble finding the normal size margarine tub, and bought a smaller one that was listed as being 17.3 oz, with a 15% bonus. That being 15% more than a 15oz, not 15% cheaper.

Coffee hasn’t been in one-pound cans (and the cans haven’t been metal) for decades.

I can’t buy ice cream by the pottle anymore.

If you buy Cafe Du Monde coffee, it comes in a metal can

I’ve lived under 10% inflation before. It totally destroys the lives of retirees (a key voting demographic).

I do not think we will see a hyperinflation (Zimbabwe or even Russia circa 1995 when they dropped three zeros from their currency and a 1000 ruble note became a 1 ruble note over night).

But I am terrified of double digit inflation setting in just as I get ready to retire.

I’m assuming I won’t be retiring anytime soon. It makes it easier to stomach what’s coming.

I don’t plan to retire either.

Yesterday I gave myself the day off. I stitched and watched TV. I don’t think I can stomach doing that day after day, with my only break being cooking and cleaning house.

Add (the right kind of) weed to that equation, and you turn boredom and restlessness in to focus and productivity.

Religious prohibition notwithstanding, I wouldn’t trust my neurons to weed. I’m already kookoo and on meds. I don’t think the mix would be anything less than disastrous.

The next conflict point is either when the left decides to spike the football in particularly egregious fashion or when the economy catches up to the fiscal lunacy.

With radical gun control bills and a war on domestic terror on the agenda, football-spiking is definitely in the air.

I don’t think the economy can catch up to the fiscal lunacy. Money supply growth has gone vertical. Productivity growth can’t possibly catch up.

By catch up, I mean we start seeing the depression that these policies have made almost inevitable.

Im seeing inflation on a daily basis now, its not getting better, catalyst? I wouldnt know. ..

What we’re starting to see is mild. When it hits double digits, the pain will get undeniable. If(?) it goes “hyper” (the classic definition of 50%/month seems . . . unreal?/unlikely?) , watch out. Annual inflation in the high teens or twenties would be very damaging, and would start pushing people out of the “too much to lose” zone.

A CD paying 12% while I have a 3% mortgage would be kind of sweet. As long as I never want to move.

And whoever is holding those mortgages (banks, pension funds, MBS, etc.) will be underwater.

My bank stock is up 20% in six weeks. Someone out there in market land is betting the banks will do o.k.

Most banks don’t hold their own mortgages. They typically have large bond holdings. Somebody is betting the bond bubble pops last, which isn’t a bad bet.

They’re just getting started.

Doing right don’t know no end.

/insert C.S. Lewis quote here

“Of all tyrannies, a tyranny sincerely exercised for the good of its victims may be the most oppressive. It would be better to live under robber barons than under omnipotent moral busybodies. The robber baron’s cruelty may sometimes sleep, his cupidity may at some point be satiated; but those who torment us for our own good will torment us without end for they do so with the approval of their own conscience.”

Thanks.

All the predictions of civil war are off because of our new technological world. Everyone watching everyone. The conflict will be against a system.

Social War In The Synopticon

https://thezman.com/wordpress/?p=22831

Good read. Thanks.

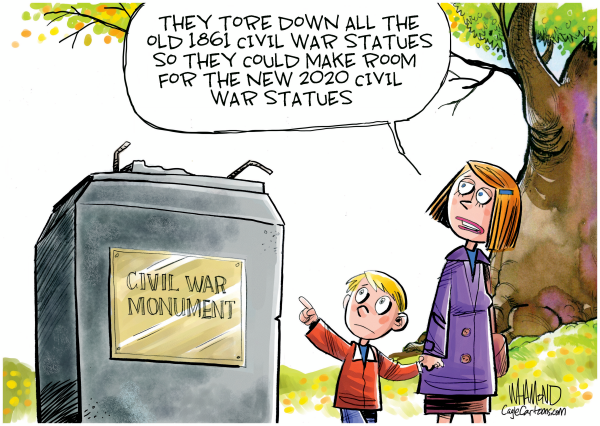

“1861 Civil War Statues?”

Were they into precognition back then too?

I have this sudden urge to put that Abraham Lincoln: Vampire Hunter movie in my watchlist for junk watching.

Maybe it was in honor of Cpl. Sumner Henry Needham (Company I, 6th Massachusetts Militia)

Or this guy…

https://en.wikipedia.org/wiki/Daniel_Hough

Nice article Trsh.

The prog-fascists got what they want, so they will enjoy their spoils. The next conflict point is either when the left decides to spike the football in particularly egregious fashion or when the economy catches up to the fiscal lunacy.

I think you have the relationship backwards here. I’ve always thought this line from 1984 was particularly apt:

.

The prog-fascists haven’t come close to getting what they want yet. All we’ve seen so far is the revolution. The dictatorship is coming.

“I thought the Nashville car bombing may be it.”

Good grief I completely forgot about that.

*checks Amazon for C-4*

KIDDING!

Wasn’t there some sort of mass shooting thingy in MN last week?

Some guy shot up a clinic because the War on Opioids was screwing him over.

None of the news stories I heard about doctors being threatened by pain patients suggested that, maybe, perhaps the patients are in fact not being given appropriate medication for their pain.

That almost certainly means it doesn’t fit the WHITE SUPREMACY theme the Idiot Class has foisted on us.

I’d argue the most sinister of all taxes are the taxes on our time. You can make more marginal dollars; you can’t really make more marginal time.

It seems that as long as there is power, and entertainment, its not likely for any disturbances reach critical mass.

Food will be the big one.

It’s unlikely that without a major environmental disaster food will be an issue in the United States.

China, on the other hand….

This. We waste food now. Upwards of 1/2. I’m sure we could adjust those habits and be fine, even if we face lower food production, and we won’t hit a point where we can’t produce enough food short of environmental disaster.

That said, any sort of more than small scale interruptions in transporting that food and we could see some trouble. It’s not enough to produce food, you have to get it where it needs to go, and those logistics are likely to break down before the ability to produce enough food does.

Thanks, Trashy.

Complete destruction of institutional trust:

I wouldn’t say complete, but when I hear my conservative pals talking shit about the Fed, it warms my heart a little.

A great number of people I know are convinced we will never see another election that isn’t

riggedfortified.I’d call that a loss in confidence in the system.

I think the election system can be restored to integrity, at least as much as it ever deserved, because I don’t believe the narrative of the pervasive control by the forces of darkness.

I don’t believe in those either.

But I do believe that should the cathedral perceive another threat, they’ll have no trouble justifying election fortification as a matter of regular business rather than some last ditch emergency effort to Secure Democracy™️.

Trashy, when you moved to TX, did you end up buying or renting?

Renting. We wanted some more time to save up a bigger down payment and scope out a more permanent landing spot.

Concerns about interest rates? Or does falling home prices help mitigate those worries?

Wife and I are considering the same plan.

We’re hoping the housing bubble pops before the inflation gets too bad. Especially in N Texas, real estate is insane. We made $70k aftet 3 years in our $200k house when we left the area, and the price has gone up another $70k in the 3 years we were gone. 70% price increase in 6 years is nutter butter crazy, and we’re currently living in an even hotter suburb, where some zip codes went up 50% in a year.

Without doing a brain dump on our strategy, the goal is to be ready to buy when our lease is up in July 2022. We’re looking more rural and quite a bit further away from DFW. The hope is that the bubble starts to pop in the interim and we get a good deal, but we’ll be prepared either way. Inflation shouldn’t move quickly enough to hurt the down payment too bad, but I don’t love the idea of having $100k sitting in the bank during inflationary times. OTOH, if things move more slowly we always have the option to extend the lease by 6 months or a year if we don’t like what we see.

Thanks. I will have quite a lot of cash after selling this one, but really don’t intend to stay long-term in our next spot. I wanted to rent but perhaps it makes more sense to just buy something.

Yeah, I’m leery about renting in inflationary times. Our original goals was to be ready 30 months from now, but I don’t want to be at the mercy of the landlord when it comes time to negotiate rent for year 3. I’d much rather have a fixed housing payment that gets inflated down.

I don’t want to own again, but rents are going up.

From Scott Alexander’s “Fictional Cryptocurrencies,” one that is actually genius:

But doesn’t that come back to “Government makes a tidy profit”?

Donation not taxation!

Hush, you.

What happened to that guy?

Commenting was just too taxing.

I think we all failed to appreciate the genius he took himself to be.

I can relate to that, dealing with you philistines can be quite trying.

Say his name a couple more times.

I was trying to parse the wannabee power people. Obviously the pols but anymore the big league media and teachers’ unions give a big middle finger. I see the military doing their own power play, they have the hardware the others are lacking. The bureaucrats (the Deep State) but they command no guns. The people, lack of organization and infrastructure.

Chaos until a power man is able to command the firepower.

I’m thinking the military/LEOs will be the decision makers

Inflation is a helluva laxative

I’m looking at land to hedge inflation somewhat. I think it’s a better investment compared to savings, bonds, or the market at this time. I should be able to secure a very low interest loan.

Precious metals, crypto, and similar hedges seem like a large risk right now. I might look to put some additional money in a commodities index, as they should go up with inflation.

I’ve started the preliminary process of looking for land, but GOOD land, even out west, is expensive.

I’ve been seeing some fairly inexpensive land for sale, but I need to see in person to determine why. I suspect it is a partial swamp or wetland during the spring based on sat and topographic pictures.

Depending on where you’re looking, the steeper the slope the cheaper the acre. Or lack of access is another tell.

The land is very accessible and in a good location for future development if wanted or a secluded cabin or house.

My other problem is that the places I favor are really goddam expensive. Places like Sky Islands in the Chihuahuan Desert in TX or NM or the Black Hills in SD/WY are astronomically expensive.

Ah inflation I remember the good old days when I walked around with millions in my pocket before they loped off 4 zeroes

+10000

the chad https://www.bnr.ro/files/d/Monede%20si%20bancnote/1mil_r.jpg

vs the virgin https://upload.wikimedia.org/wikipedia/commons/4/41/100_lei._Romania%2C_2005_a.jpg

also in the 40s

https://media2.allnumis.com/000_42099123L.jpg

I’ve got a 5,000,000,000 Yugoslavian dinar note around somewhere.

The problem is they used a decimal point instead of a comma, making it nearly worthless.

You’re meant to be in the Euro by now.

ranting in the comment section of your favorite media outlet.

Shit.

I think we are in a quiet phase. I’m going to go out on a limb here and predict things will heat up as we get closer to the election, regardless of the economy.

My guess as to how the ancien regime will try to deal with these pressures – war. Turn our national aggressions outward and justify price controls and rationing.

Most likely.

America is going to make the rest of the world miserable because of our own domestic failures.

Wow, Larry King’s estate is only worth $2 million…

https://www.newsmax.com/thewire/larry-king-shawn-king-will-contest/2021/02/16/id/1010207/

Wasn’t he divorced like eight times? I imagine he didn’t make the best financial decisions either.

On second thought, he did pretty well. Ideally you want to go out right after spending your last hundo on hookers and blow, but you need to have somewhere to live and clothes and such so for him to only leave behind 2 mil is proof he tried to spend it all. Good for him.

My father says his will reads: “Being of sound mind and body, I spent it all . . . . . “

Is that any surprise with 87 ex-wives?

Whoever the current one is won the Larry King musical wives contest.

Shawn King? The crappy old Buccaneers QB?

Either that or Talcum X.

dammit

No, no… Shaun King, Talcum X

I’ve decided I don’t have a very good understanding of value.

The fab here cost >$1G to build. Our sales are (finally) greater than that. But we make extremely value-dense products — we never have lines of trucks hauling product out and we absolutely don’t have our own rail spur.

CZ bought Colt. In addition to all of their physical facilities, they have ongoing contracts with FedGov that have to be worth (I would have thought) lots. But CZ paid like $220M for the company. Did Colt have stupidly large debts?

Colt must have been really leveraged. I imagine CZ only got the name, brand, and IP for their products. Possibly a small factory or two and the contracts with the US gov.

Maybe it’s all assets and not so much goodwill with a gun manufacturer purchase.

“With this strategic move, CZG will acquire significant production capacity in the United States and Canada and substantially expand its global customer base,” the Czech company said.

“Colt has struggled as the firearms industry has grown and its design patents expired.”

Did Colt have stupidly large debts?

Yes.

“Colt has struggled as the firearms industry has grown and its design patents expired.”

Does Colt even have a meaningful intellectual property portfolio?

Sure, but who drinks malt beer anymore?